Consumer Proposal vs. Bankruptcy - Which is Right for You?

- Bryan Litvack

- Jan 23, 2023

- 7 min read

Key Takeaways

A bankruptcy and consumer proposal will both help you reach the goal of becoming debt free, but you need to review your financial situation and your long-term goals to see which option is best for you. Speaking with a Licensed Insolvency Trustee can help guide you toward understanding the difference between both options.

When faced with overwhelming debt, many people turn to a consumer proposal and personal bankruptcy as a last resort. Both are debt solutions that can give you a fresh start financially and help you get back on your feet. But which one is right for you? In this article, we will explore the differences between consumer proposals and bankruptcy, the advantages and disadvantages of each option, and how to decide which is the best choice for you.

What is a Consumer Proposal and Bankruptcy?

A consumer proposal and bankruptcy are two different types of debt relief options available in Canada through the Bankruptcy and Insolvency Act. Both of them involve reducing the debts you owe to your unsecured creditors.

Bankruptcy is a legal process that frees you from most of your debts. It can be voluntary when an insolvent person makes an assignment of their property for the general benefit of creditors, or involuntary when a creditor makes an application to the court for a bankruptcy order. In bankruptcy, you may have to surrender assets to the Licensed Insolvency Trustee (LIT) and make monthly payments.

A consumer proposal is an agreement between a debtor and their creditors where you agree to pay an agreed amount over a period of time. It's a formal agreement between you and your creditors that is legally binding and is administered by a LIT. A consumer proposal should be considered as an alternative to bankruptcy and should be attempted if you can.

Which Debts are Included in a Consumer Proposal or Bankruptcy?

A consumer proposal and bankruptcy both include the same types of unsecured debts such as:

Credit cards;

Lines of credit;

Bank loans;

Personal loans;

Payday loans;

Taxes;

Student loans, if more than 7 years from completing studies;

Vehicle loans (if a vehicle is returned).

A bankruptcy or consumer proposal does not include secured debts such as a mortgage or car loan. These debts are backed by an asset, which you can keep in both options, as long as you continue making payments.

How are a Consumer Proposal and Bankruptcy Similar?

A consumer proposal and personal bankruptcy both offer protection from creditors and the courts, by stopping collection calls and interest charges. For both options, you will work with a Licensed Insolvency Trustee to administer either option and communicate with your creditors.

Both options require you to attend two financial counselling sessions with a BIA counsellor. During these sessions, the counsellor will work with you on developing a monthly budget for all of your household income, monthly expenses and bankruptcy or consumer proposal payments.

What are the Differences Between a Consumer Proposal and Bankruptcy?

While consumer proposals are similar in that they both include the same unsecured debt, there are some differences:

| Consumer Proposal | Bankruptcy |

Eligibility | Up to $250,000 of unsecured debt (excluding principal residence) | Minimum of $1,000 of unsecured debt |

Time to complete | Up to 5 years, can be completed early | 9 to 36 months depending on income and if previously bankrupt |

Reporting requirements | No monthly reporting | Monthly reporting of income to Trustee |

Assets | Keep all assets | Surrender all non-exempt assets to Trustee |

Cost | Monthly payments on the total settlement with your creditors. Total settlement/60 months = monthly payment | Monthly payments based on your average net income, as per government regulations |

Credit rating | R7 rating on credit record for 3 years after completion date or 6 years after filing date, whichever comes first | R9 rating on credit record for 7 years after completion |

How to Decide Between Consumer Proposal and Bankruptcy?

When deciding between a consumer proposal and bankruptcy, it's essential to consider your individual circumstances. If you have full-time employment and can afford the payments, a consumer proposal may be the right choice for you. In many cases, your monthly debt payments could be reduced in half or more.

On the other hand, if you have a large amount of debt and have been unable to make payments, bankruptcy may be the better option. Also, if you are not currently working or your income is not steady, it may be difficult to maintain monthly payments, so bankruptcy may be an easier option to discharge your debts.

It is also important to look at the pros and cons of each option and decide which one is right for your situation. Consider factors such as how long the process will take, the impact on your credit score, and the amount of debt that can be included in the process.

How Long Does it Take to Complete - Consumer Proposal vs Bankruptcy?

On average, bankruptcy is usually completed sooner than a consumer proposal. Personal bankruptcy can take from 9 months for a first-time bankruptcy to over 36 months for multiple bankruptcies. The length of time is determined by the amount of the monthly payments, if you were previously bankrupt and if you complete all of your duties.

A consumer proposal typically takes from three months up to 60 months, which is the maximum period. Most consumer proposals are for 60 months to provide you with the lowest monthly payments, to ensure won't default on the terms of the consumer proposal. However, once your creditors accept it, you can increase your payments to pay off the consumer proposal early. You can find out more about the process to complete a consumer proposal here.

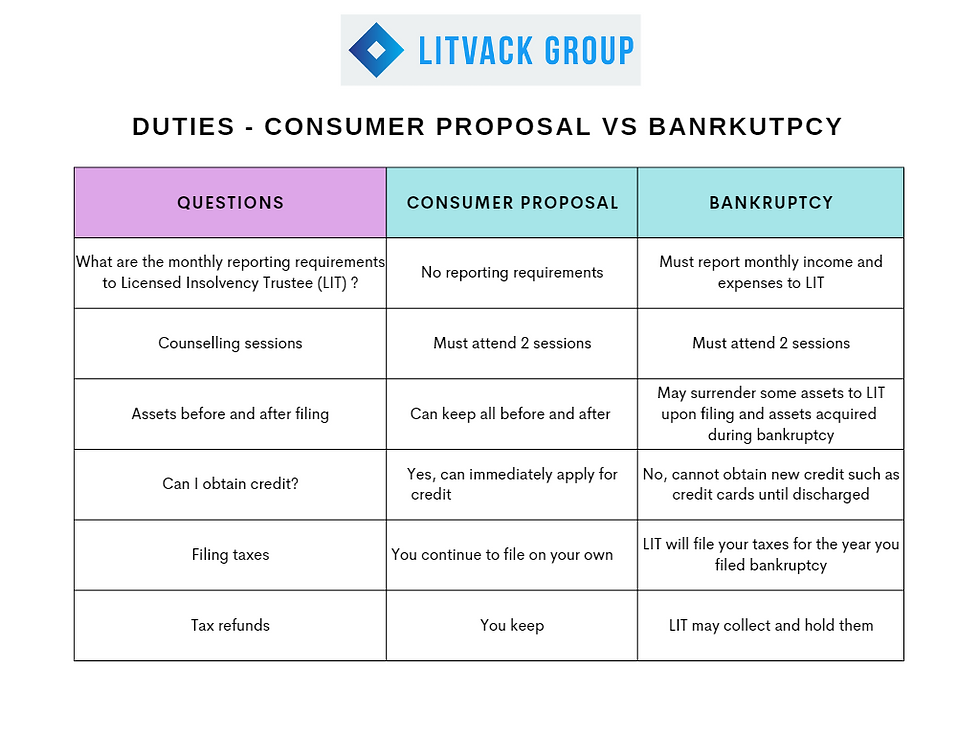

Comparing Monthly Reporting and Duties

What Happens if My Income Changes?

In a bankruptcy, you will need to submit monthly income statements to the Licensed Insolvency Trustee along with proof of income such as a pay stub. At the beginning of the process, the LIT will estimate your bankruptcy payments based on your prior income earned. If your income goes up or down during the bankruptcy period, your monthly payments may increase or decrease. Therefore, if you are expecting a raise during the bankruptcy period you will want to consider that when choosing between filing bankruptcy or a consumer proposal.

In a consumer proposal, your income is calculated based on your income earned prior to signing the consumer proposal documents. Once the consumer proposal is filed and accepted by your creditors, your payments are locked-in. This means if your pay increases or decreases during the proposal, your payments won't change.

What if I Change My Mind? Switching From One Option to Another

When deciding between a consumer proposal vs bankruptcy, you may be worried that you may change your mind during the process and that you are locked into the chosen option. The good news is you can change from one option to another.

If you initially completed bankruptcy filing, prior to completing the bankruptcy, you could switch to a consumer proposal. You would need to advise the Trustee, who will assist you in making the transition.

If you initially completed consumer proposal filing and find that you can't keep up with the payments, you can at any point file for personal bankruptcy. However, waiting for the proposal to be annulled may be best before you declare bankruptcy. The bankruptcy would include all debt included in the consumer proposal, plus any new debts incurred since filing it.

Will Consumer Proposal and Bankruptcy Show up on Public Records?

Both options will be reported to credit agencies and will appear on your credit report. Bankruptcy will appear as an R9 rating and consumer proposal as an R7 rating and both may negatively impact your credit rating.

Otherwise, your bankruptcy or consumer proposal filing will only show up on the Office of Superintendent of Bankruptcy's website. On their website, a person or company must pay at least $8 per search, so that information is not available without first paying a fee. Therefore, it is very unlikely that someone could find out whether you filed for bankruptcy or a consumer proposal based on a Google search.

How does each option affect my credit?

Both a consumer proposal and bankruptcy will have an impact on your credit score as credit reporting agencies are notified. A consumer proposal will stay on your credit report for three years after it's completed up to a maximum of 6 years from when filed, while a first-time bankruptcy will stay on your credit report for seven years after it's completed and a second-time bankruptcy will stay for 14 years after completed.

During and after completing these options, it's important to take steps to rebuild your credit, such as making all of your payments on time.

What to Expect During a Consumer Proposal and Bankruptcy

If you decide to pursue a consumer proposal, you'll need to work with a Licensed Insolvency Trustee who will negotiate a deal with your creditors on your behalf. The Trustee will be available to answer any of your questions or concerns during the whole process.

If you decide to pursue bankruptcy, you may be required to surrender some of your assets,

including your home, car and investments, and you'll be required to make payments over a 9-month to 36-month period.

If you decide to pursue a consumer proposal, you can keep all of your assets and any future assets you may acquire. Your main responsibility will be to make the agreed payments to the Trustee who will distribute the money to your creditors.

With both options, you should expect the relief of not having any more collection calls, letters or emails. You will just be responsible for your scheduled payments and performing your duties, as required such as attending the financial counselling sessions.

Conclusion

When faced with unmanageable debt, consumer proposals and bankruptcy can be good debt solutions for getting back on your feet financially. However, both options have their pros and cons, so it's important to consider your financial situation and decide which one is right for you.

No matter which option you choose, the most important thing is to take steps to rebuild your credit and manage your debts responsibly. With the right plan in place, you can get back on the path to financial freedom.

If you're considering a consumer proposal or bankruptcy, it's essential to speak with a Licensed Insolvency Trustee to discuss your options and to determine which one is best for your situation. They can help you through the process and ensure that you get the best possible outcome.

Litvack Group would happy to provide you with a free, no-obligation consultation to discuss your financial situation and help find the right debt solution for you.

Comments